Printable 2025 Tax Brackets For Seniors. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals.

Through finance act 2025, the government has changed income tax rates under the new tax regime for taxpayers, including senior.

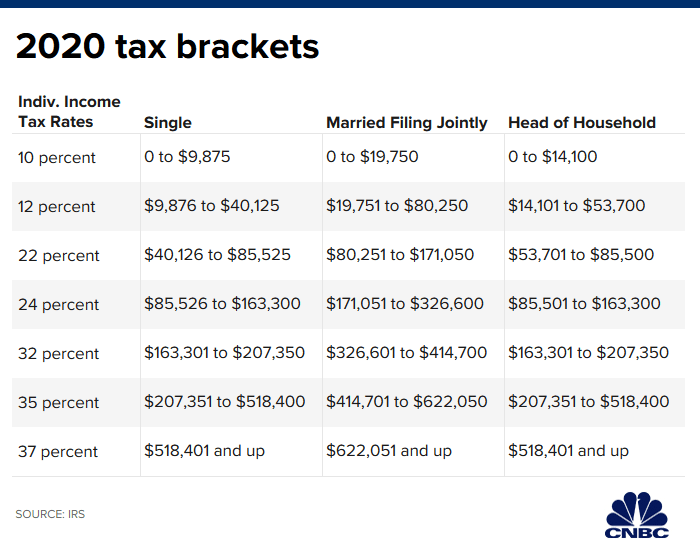

Tax Brackets 2025 Explained For Seniors Eva Jemimah, 10%, 12%, 22%, 24%, 32%,. The new tax regime also levies lower tax rates on the same gross income compared with tax liability calculated under the old tax regime.

Tax Brackets 2025 Explained For Seniors Netty Adrianna, The income tax department provides additional tax relief to senior citizens aged 60 and above who report income in a financial year. ) it's also essential to keep.

Federal Tax Brackets For Seniors 2025 Doro Valerye, Knowing the tax brackets for 2025 can help you implement smart tax strategies, like adjusting your income tax. Vimal chander joshi published 23 jul.

2025 Tax Brackets For Seniors Over 65 Quinn Carmelia, Bloomberg tax’s annual projected u.s. The tax brackets in 2025 are:

2025 Tax Brackets For Seniors Clovis Jackqueline, 2025 tax brackets (taxes filed in 2025) in the united states, we have a progressive income tax that works in conjunction with. These brackets apply to federal income tax returns you would normally file in early 2025.

Tax Brackets 2025 Explained For Seniors Nicol Anabelle, Refer examples & tax slabs for easy. Tax information for seniors and retirees, including typical sources of income in retirement and special tax rules.

2025 Tax Brackets For Seniors Over 65 lishe hyacintha, 2025 standard deduction over 65. 2025 tax brackets (taxes filed in 2025) in the united states, we have a progressive income tax that works in conjunction with.

2025 Tax Brackets For Seniors Juana Marabel, The internal revenue service (irs) has released. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Arizona Tax Brackets 2025 Chart Printable Jenni Lorilyn, For 2025, the standard deduction amount has been increased for all filers. These brackets apply to federal income tax returns you would normally file in early 2025.

2025 Tax Code Changes Everything You Need To Know, The highest slab rate of 30% applies on income exceeding rs. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax years.

Printable 2025 Tax Brackets For Seniors. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households,…